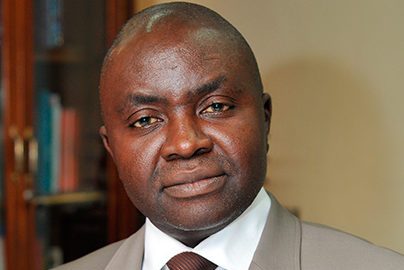

The Director of the Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf has stated that monetary policy tools like interest rate hiking have been ineffective in tackling inflation in Nigeria

Dr. Yusuf stated this during an interview with Arise TV on the outlook for the manufacturing sector in the country in 2024.

The CEO of the CPPE argued that if the increase in interest rates can curb inflation, then Nigeria shouldn’t be experiencing the high inflation it is witnessing now. He went further saying, that there is a need to address the primary drivers of inflation in the country and listed food, transportation, and others.

According to him,

- “Under the previous regime of the Central Bank, we have seen a continuous tightening of monetary policy, and the concept of monetary policy tightening is to increase interest rate.”

- “Our MPR is at 18.75% if monetary policy tools can tackle inflation, then inflation will have been subdued by now, given all the monetary policy tools and tightening that has taken place over the last two years”

- “This economy is not the type of economy where the interest rate can effectively fight inflation”

He also alluded to the Ways and Means finances of the previous administration being a contributory factor to the current high inflation being witnessed in Nigeria.

FG should facilitate investment in raw material production

Speaking further, Dr. Yusuf called on the federal government to ensure the facilitation of investment in industries that produce raw materials for manufacturers to reduce exposure to the volatility of the forex market.

He used the automobile industries as an illustration stating that the federal government can facilitate investment in the aluminum, iron, and steel sectors to ensure the inputs needed for that sector are locally sourced.

What you should know

- The previous administration of the CBN under the leadership of Godwin Emefiele had consistently increased the interest rate to 18.75% in July as a measure to curb inflation. However, the move seemed counterproductive as inflation rose for the sixth consecutive month in July to 24.08%.

- As of November, Nigeria’s inflation stands at an 18-year high of 28.2%- marking ten months of consecutive increase.