Tangerine APT Pensions Limited is the resulting entity formed from the merger of Apt Pension Funds Managers Limited and Tangerine Pensions Limited.

Analysis:

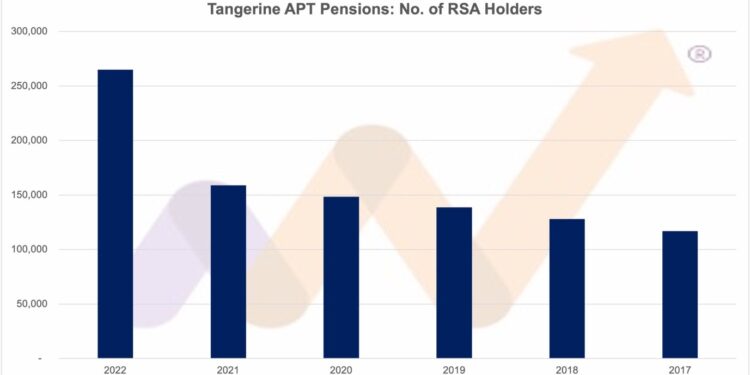

Tangerine APT Pensions ended the 2022 financial year with 264,947 RSA holders in the 7 publicly available RSA funds, an increase of 105,948 RSA holders from 158,999 accounts in 2021.

Additionally, assets under management for the 7 audited Retirement Savings Accounts (RSAs) funds published was ₦185.63 billion, up 75% from ₦105.79 billion in 2021.

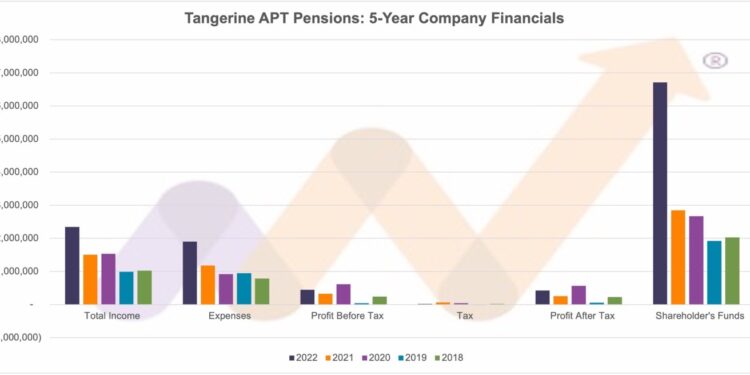

Performance Analysis: Company

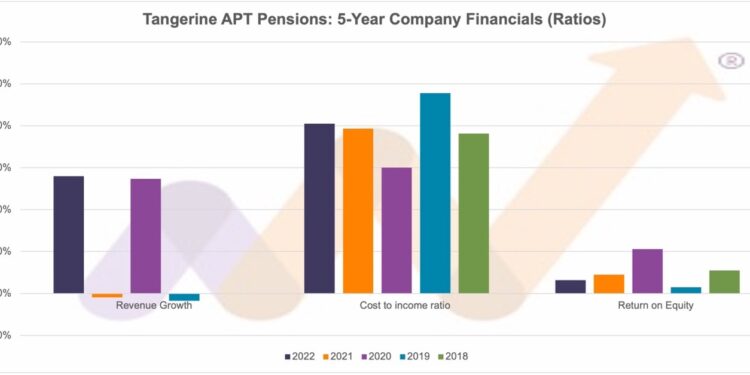

Revenue for the fiscal year ending on December 31, 2022, amounted to ₦2.34 billion, up 56% when compared to revenue of ₦1.50 billion recorded in 2021.

- Total expenses increased by 61% and to reach ₦1.90 billion from ₦1.18 billion in 2021.

- The company recorded a profit after tax (PAT) of ₦427 million, growing 67% from ₦256 million in 2021.

- As shareholders’ funds closed in 2021 at ₦2.85 billion, the company raised needed to increase its shareholders funds to the new regulatory minimum of ₦5.0 billion.

- For the year ended December 2022, shareholders’ funds closed at ₦6.71 billion following a capital injection.

- Return on equity (ROE) for the year 2022 was 6.36% compared to 8.98% in 2021.

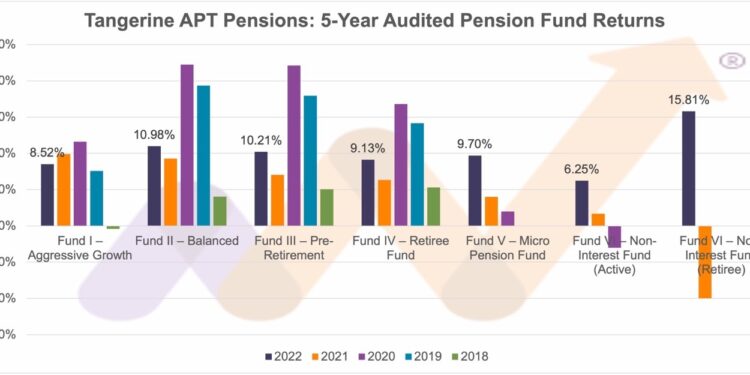

Performance Highlights: Access RSA Funds (audited)

For the period ending on December 31, 2022, Tangerine APT Pensions Fund I appreciated of 8.52%, while Fund II appreciated by 10.98%. Fund III recorded a growth of 10.21%, Fund IV appreciated by 9.13%, and Fund V by 9.70%. The specialized funds, Fund VI – Non-Interest (Active) and Fund VI – Non-Interest (Retiree), experienced respective increases of 6.25% and 15.81%.

The pension industry does not currently benchmark the performance of any fund to any performance index. In the absence of any benchmark index to measure/compare fund performances for the year 2022, and to aid readers’ indirect comparison, the NGX All-Share Index (a measure of performance of the Nigerian stock market) appreciated by 19.98%, the NGX Pension Index appreciated by 16.96%, inflation was 21.47% and MPR closed the year at 16.50%, having risen steadily through the year.

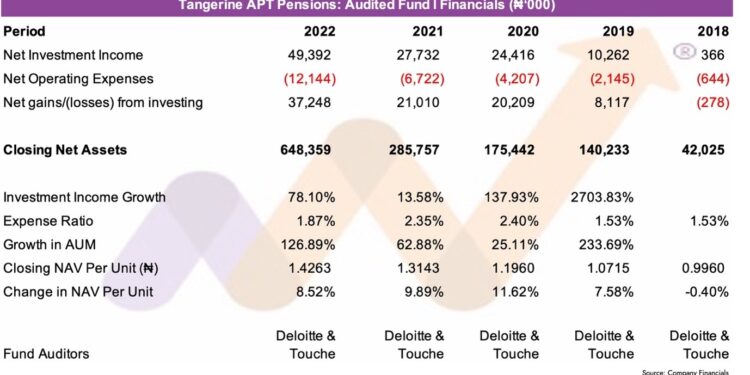

Tangerine APT Pensions Fund I highlights:

- Fund I performance: up 8.52% in 2022, lower than the 9.89% in 2021 and still lower than the 11.62% in 2020.

- Fund I income was up 78% to ₦49.39 million in 2022, from ₦27.73 million in 2021 and ₦24.42 million in 2020.

- Fund size: the size of the fund, measured by net assets, grew 127% to ₦648.36 million from ₦285.76 million in 2021.

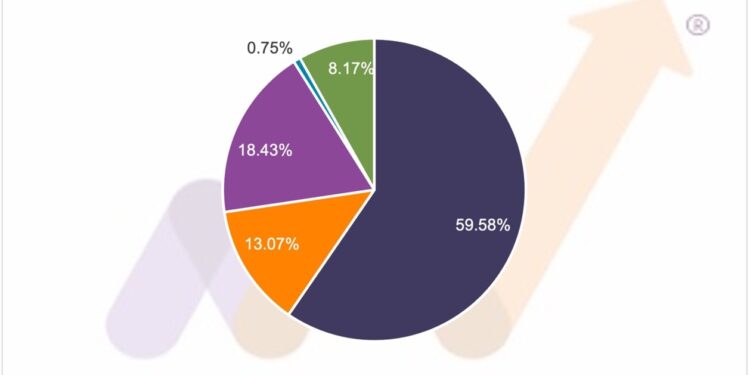

- Asset Allocation (31-12-2022): Fixed Income Instruments 59.58% (2021: 59.15%), Equities 13.07% (2021: 21.90%), Money Market instruments 18.43% (2021: 12.21%), Cash 0.75% (2021: 6.74), Others 8.17% (2021: 0.00%).

- Performance ranking: The fund performance for 2021 was ranked 2 out of 19 in our on Pensions.

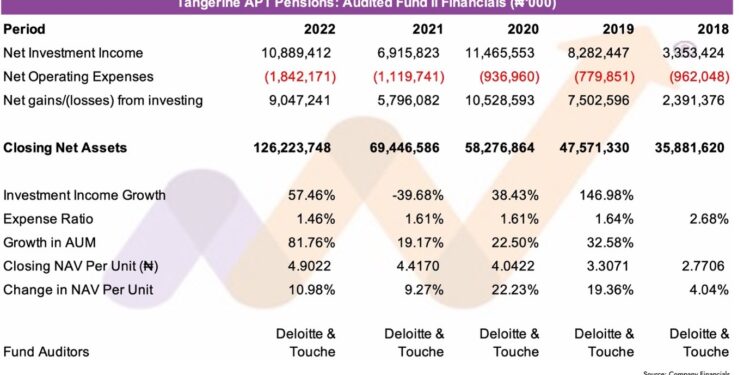

Tangerine APT Pensions Fund II highlights:

- Fund II performance: up 10.98% in 2022, compared to 9.27% in 2021 and 22.23% in 2020.

- Fund II income was up 57% to ₦10.89 billion in 2022. This was up on ₦6.92 billion in 2021 but down on ₦11.47 billion in 2020.

- Fund size: Fund II grew almost 82% to ₦126.22 billion from ₦69.45 billion in 2021.

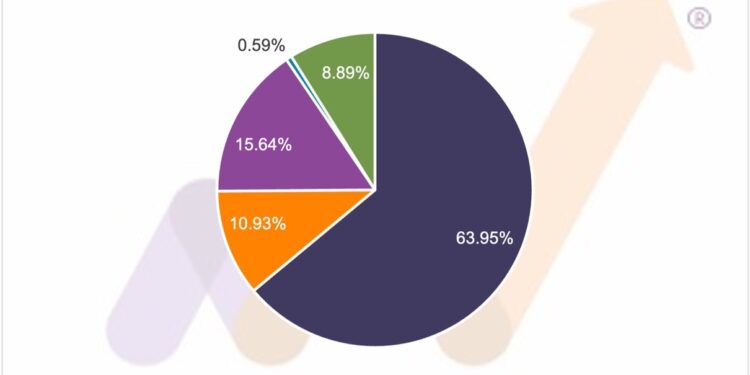

- Asset Allocation (31-12-2022): Fixed Income Instruments 63.95% (2021: 71.78%), Equities 10.93% (2021: 16.69%), Money Market instruments 15.64% (2021: 5.30%), Cash 0.59% (2021: 0.26%), Others 8.89% (2021: 5.97%).

- Performance ranking: The fund performance for 2021 was ranked 1 out of 19 in our on Pensions.

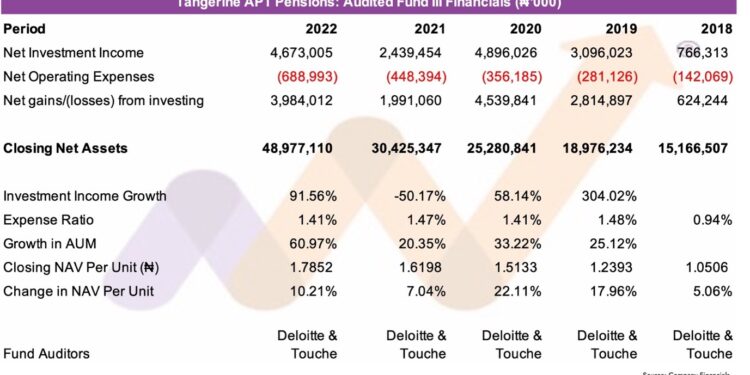

Tangerine APT Pensions Fund III highlights:

- Fund III performance: was 10.21% in 2022, compared to 7.04% in 2021 and 22.11% in 2020.

- Fund III income was up 92% to ₦4.67 billion in 2022 from ₦2.44 billion in 2021 and down on ₦4.9 billion in 2020.

- Fund size: Fund III grew 61% to ₦48.98 billion from ₦30.43 billion in 2021.

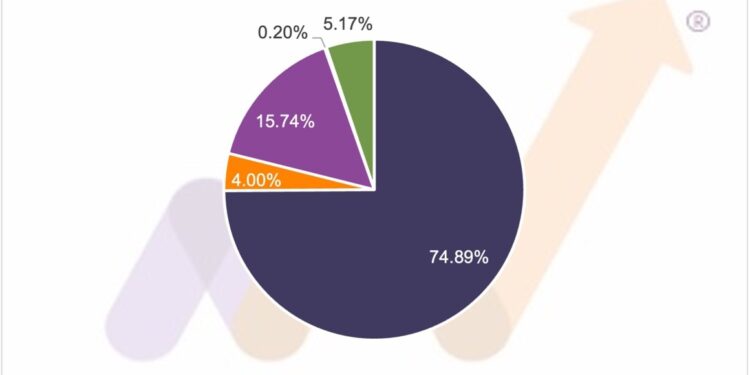

- Asset Allocation (31-12-2022): Fixed Income Instruments 74.89% (2021: 82.25%), Equities 4.00% (2021: 7.76%), Money Market instruments 15.74% (2021: 9.42%), Cash 0.20% (2021: 0.57%), Others 5.17% (2021: 0.00%).

- Performance ranking: The fund performance for 2021 was ranked 16 out of 19 in our .

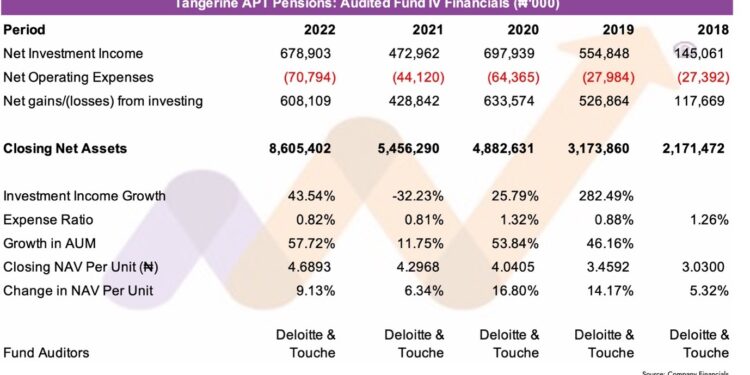

Tangerine APT Pensions Fund IV highlights:

- Fund IV performance: up 9.13% in 2022, compared to 6.34% in 2021 and 16.80% in 2020.

- Fund IV income: ₦678.91 million in 2022, up 44% from ₦472.96 million in 2021 but down on the ₦633.57 million in 2020.

- Fund size: Fund IV grew almost 58% to ₦8.61 billion, from ₦5.46 billion in 2021.

- Asset Allocation (31-12-2022): Fixed Income Instruments 73.83% (2021: 78.96%), Equities 3.67% (2021: 3.63%), Money Market instruments 11.42% (2021: 14.72%), Cash 3.99% (2021: 2.69%), Others 7.09% (2021: 0.00%).

- Performance ranking: The fund performance for 2021 was not ranked in our on Pensions as accounts were not made public.

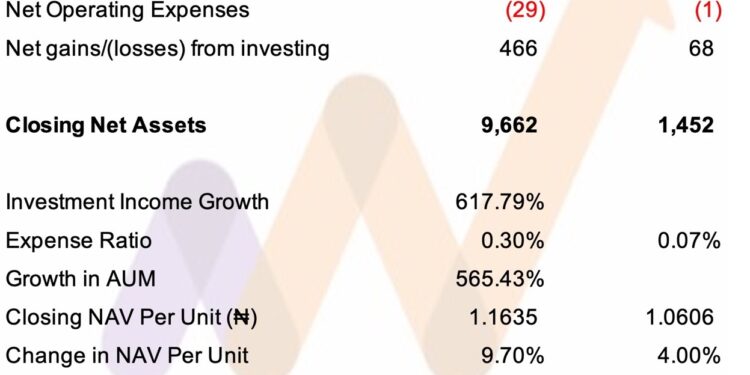

Tangerine APT Pensions Fund V highlights:

- Registered Fund V RSA holders: Tangerine APT Pensions had 7,011 Fund V RSA holders as of 31 December 2022, up from a combined 4,527 in 2021. Total industry Micro Pension RSA holders in 2022 were 89,327, giving Tangerine APT Pensions a 7.85% market share.

- Total assets in the fund: ₦9.66 million in 2022, up from 1,462 million in 2021.

- Fund V income: Net fund income for the fund was ₦495,000, up from ₦69,000.

- Fund V performance: up 9.70% in 2022, compared to 4.00% in 2021.

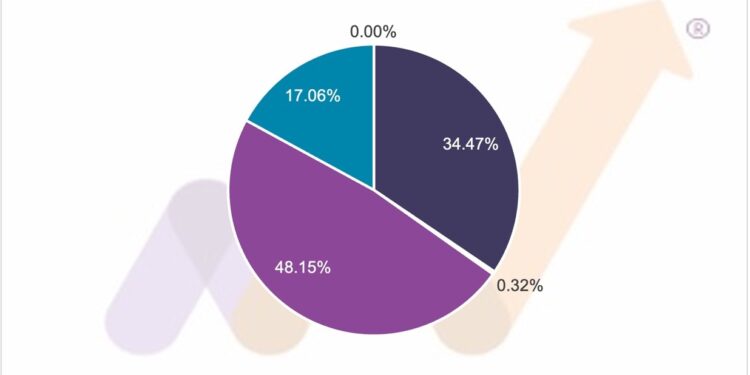

- Asset Allocation (31-12-2022): Fixed Income Instruments 34.47%, Equities 0.32%, Money Market instruments 48.15%, Cash 17.06%, Others 0.00%. 2021 comparison data unavailable.

- The fund performance for 2021 was ranked 11 out of 14 in our on Pensions.

Tangerine APT Pensions Fund VI – Non-Interest (Active) highlights:

- Income for the year was ₦55.52 million in 2022, up on ₦49 million in 2021.

- Fund performance: up 6.25% in 2022, compared to 1.67% in 2021.

- Fund size: Fund VI non-interest (Active) was ₦1.11 billion compared to ₦161 million in 2021.

- Asset Allocation (31-12-2022): Fixed Income Instruments 79.59%, Equities 11.18%, Money Market instruments 9.23%, Cash 0.00%, Others 0.00%. 2021 comparison data unavailable.

- Performance ranking: The fund performance for 2021 was ranked 11 out of 11 in our on Pensions.

Tangerine APT Pensions Fund VI – Non-Interest (Retiree) highlights:

- Income for the year was ₦4.8 million in 2022.

- Fund size: Fund VI non-interest (Retiree) was ₦60.75 million, up from ₦10.64 million in 2021.

- Fund performance: up 15.81% in 2022.

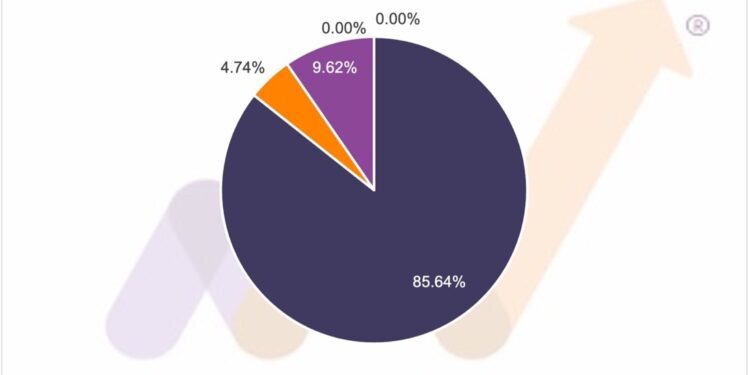

- Asset Allocation (31-12-2022): Fixed Income Instruments 85.64%, Equities 4.74%, Money Market instruments 9.62%, Cash 0.00%, Others 0.00%. 2021 comparison data unavailable.

- Performance ranking: The fund performance for 2021 was ranked 5 out of 5 in our on Pensions.

Watch out for our 2023 report detailing all fund rankings for 2022 in the 2023 Money Counsellors Annual Report on Pensions (MCARP 2023). Download the 2022 report .

This article was written by Michael Oyebola. For more information and analysis, visit moneycounsellors.com